Many small companies in the UK don’t need an audit of their annual accounts (unless the company’s articles of association stipulate it or enough shareholders ask for one) but it is important to have this confirmed by an independent accountant, particularly if the UK company is part of a wider group.

Companies in the UK may need an audit of their annual financial statements based on a number of factors, set out below. It is important to have this confirmed by an independent accountant, particularly if the UK company is part of a wider group.

Which companies need an audit?

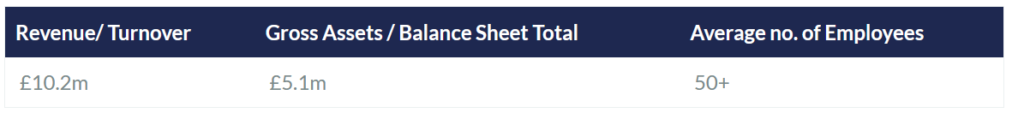

The answer is more complicated than most businesses would like and depends on a number of factors. Company size is a key factor and meeting or exceeding two of the below criteria in a financial year will mean the company is required to have a statutory audit:

The audit exemption criteria must be satisfied for two successive years in order to avoid needing an audit. In these circumstances the company will still need to prepare statutory financial statements, please see our article “Do I need to prepare accounts?” for more details.

What about parent companies and subsidiaries?

Where the UK company is a subsidiary, the above criteria needs to be reviewed on a group basis to ascertain whether an audit is required for the UK company.

There are some exceptions to this rule, where parent companies are located within specific regions. However, these rules are subject to change and it is important to request advice from a professional accountant where necessary.

Why else might a company be required to have an audit?

Certain organisations (professional bodies and charities for example) have additional regulations to comply with and would therefore still require an audit.

In particular, a company must have an audit if at any time in the financial year it has been:

- a public company (unless it’s dormant);

- an authorised insurance company or carrying out insurance market activity;

- involved in banking or issuing crypto currency/e-money;

- a member of an ineligible group; or

- a ‘Markets in Financial Instruments Directive’ (MiFID) investment firm or an ‘Undertakings for Collective Investment in Transferable Securities’ (UCITS) management company.

Why have a voluntary audit?

Even though an audit may not be required by law, many companies opt to have their financial statements audited, either for their own peace of mind or because they want to raise finance.

Financiers (such as banks) will often require audited financial statements and many suppliers and customers may prefer to do business with you if you have been audited.

Audits provide valuable management information which you can use to review business performance and internal processes.

How we can help

Here at ZEDRA Corporate Reporting Services, our specialist, qualified audit team is an essential resource for multinational companies and UK SMEs. Our audit services will:

- monitor and review audit risks

- provide reasonable assurance in relation to the true and fair review given by a company’s financial statements

- assess key business risks, economy and efficiency

- monitor and strengthen internal control procedures

A list of our other services can be found on our website – www.zedra.com